inheritance tax rate kansas

Kansas requires you to pay taxes if youre a resident or nonresident who receives income from a Kansas source. Like most states kansas has a progressive income tax with tax rates.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

As of 2021 the six states that charge an inheritance tax are.

. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Estate tax and inheritance tax in kansas estate planning. The kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased.

For example Indiana once had an inheritance tax but it was removed from state law in 2013. The kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased. The federal estate tax is calculated on the value of the.

Iowa is phasing out its. Inheritance tax rates differ by the state. The surviving spouse and children are exempt from an inheritance tax.

Many cities and counties impose their. Rates and tax laws can change from one year to the next. State inheritance tax rates range from 1 up.

The amount of federal estate tax that will be levied on an estate depends upon the size of the taxable estate and there is a maximum federal estate tax rate of forty percent. These states have an inheritance tax. The state sales tax rate is 65.

The maximum estate tax rate will remain at 16 percent and the inheritance tax will also remain the same. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. State inheritance tax rates range from 1 up.

Does Kansas Have An Estate Or Inheritance Tax. 6 rows Kentucky inheritance taxes should be filed within 18 months of the decedents death. Another states inheritance laws may.

The state income tax rates range from 0 to 57 and the sales tax rate is. The standard Inheritance Tax rate is 40. The top estate tax rate is 16 percent exemption threshold.

Kansas taxes Social Security income only for those with an Adjusted Gross. In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. Estate Taxes Can Take A Bite Out Of Your Inheritance Income.

General Sales Taxes And Gross Receipts Taxes Urban Institute

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Death And Taxes Nebraska S Inheritance Tax

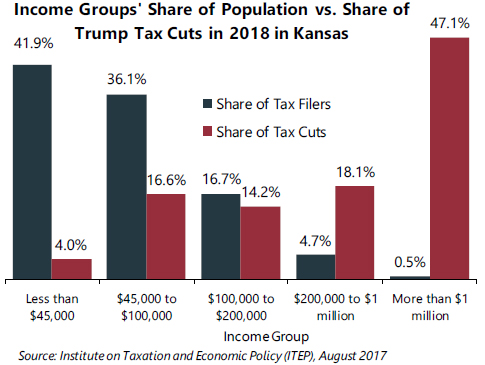

In Kansas 47 1 Percent Of Trump S Proposed Tax Cuts Go To People Making More Than 1 Million Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kc Region Taxes Financial Incentives Profile Kcadc

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Is A Gift Of Equity Kansas City Real Estate Lawyer

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Death Tax Hikes Loom Where Not To Die In 2021

What Is Inheritance Tax Probate Advance

Kansas Inheritance Laws What You Should Know

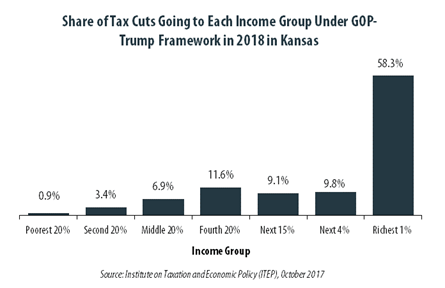

Gop Trump Tax Framework Would Provide Richest One Percent In Kansas With 58 3 Percent Of The State S Tax Cuts Itep

State By State Estate And Inheritance Tax Rates Everplans

How Do State And Local Property Taxes Work Tax Policy Center

State By State Estate And Inheritance Tax Rates Everplans

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation