fremont ca sales tax rate 2019

The state tax rate the local tax rate and any district tax rate that may be in effect. The County sales tax rate is 025.

What Are California S Income Tax Brackets Rjs Law Tax Attorney

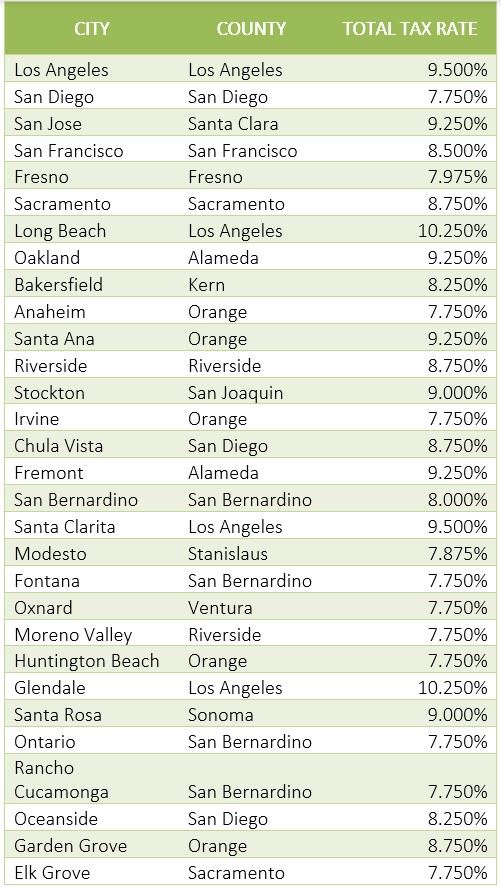

As of July 1 the sales and use tax rate is 95 percent in Los Angeles 925 percent in San Jose 85 percent in.

. State Local Sales Tax Rates as of January 1 2019. Texas Sales Tax Rate 2019. This is the total of state county and city sales tax rates.

Property Tax in Alameda County. 1025 Fremont California sales tax rate details The minimum combined 2021 sales tax rate for Fremont California is 1025. Anaheim CA Sales Tax Rate.

The sales and use tax rate in a California locale has three parts. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. This is the total of state county and city sales tax rates.

There is no applicable city tax. 4 rows Rate. Texas Sales Tax Rate 2019.

For Sale - 622 Fremont Way Sacramento CA - 649000. Collected from the entire web and summarized to include only the most important parts of it. These rates are weighted by population to compute an average local tax rate.

Historical Tax Rates in California Cities Counties. Some cities and local governments in Alameda County collect additional local sales taxes which can be as high as 45. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

A City county and municipal rates vary. There is no applicable city tax. 1788 rows California City County Sales Use Tax Rates effective April 1.

The 6 sales tax rate in Fremont consists of 6 Michigan state sales tax. View Property Ownership Information property sales history liens taxes zoningfor 1660 Peralta Blvd Fremont CA 94536 - All property data in one place. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Fremont CA.

View details map and photos of this single family property with 3 bedrooms and 2 total baths. Bidders need not be present at the Courthouse. B Three states levy mandatory statewide local add-on sales taxes at the state level.

025 A county-wide sales tax rate of 025 is applicable to localities in Alameda County in addition to the 6 California sales tax. The County sales tax rate is. The Fremont sales tax rate is.

Bakersfield CA Sales Tax Rate. A combined city and county sales tax rate of 325 on top of Californias 6 base makes Fremont one of the more expensive cities to shop in with 1766 out of 1782 cities having a sales tax rate this low or lower. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Fremont CA.

You can print a 6 sales tax table here. Can be used as content for research and analysis. The Alameda County California sales tax is 925 consisting of 600 California state sales tax and 325 Alameda County local sales taxesThe local sales tax consists of a 025 county sales tax and a 300 special district sales tax used to fund transportation districts local attractions etc.

Bidders must place their bids online. The California sales tax rate is currently 6. Saturday April 16 2022 1000 AM - 100 PM.

What is the tax rate in Fremont CA. Year Property class Assessment value Total tax rate Property tax. For tax rates in other.

Including the evolution of the total tax rate and corresponding property tax. The 2019 annual Tax Sale will be held by the Fremont County Treasurer on Monday June 17 2019 in the Treasurers office on the first floor of the Fremont County Courthouse 501 Filmore Sidney IA beginning at 900 am. Fremont collects the maximum legal local sales tax.

The minimum combined 2022 sales tax rate for Fremont California is. Collected from the entire web and summarized to include only the most important parts of it. The Alameda County Sales Tax is collected by the merchant on all qualifying sales made.

Asnydercofremontiaus NOTICE TO TAX SALE PURCHASERS OF THE TERMS AND CONDITIONS GOVERNING THE ANNUAL TAX SALE OF JUNE 17 2019 AND ADJOURNMENTS OR ASSIGNMENTS THEREOF The 2019 annual Tax Sale will be held by the Fremont County Treasurer on Monday June 17 2019 in. There is no applicable county tax city tax or special tax. You can print a 1025 sales tax table here.

California 1 Utah 125 and Virginia 1. The California sales tax rate is currently. The 1025 sales tax rate in Fremont consists of 6 California state sales tax 025 Alameda County sales tax and 4 Special tax.

How To File And Pay Sales Tax In California Taxvalet

California Sales Tax Guide For Businesses

Sales Tax Rates In Major Cities Tax Data Tax Foundation

How To File And Pay Sales Tax In California Taxvalet

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County

Food And Sales Tax 2020 In California Heather

California Sales Tax Rates By City County 2022

Food And Sales Tax 2020 In California Heather

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Food And Sales Tax 2020 In California Heather

How To File And Pay Sales Tax In California Taxvalet

Tax Checklist For The Self Employed Military Spouse Nextgen Milspouse Tax Checklist Military Spouse Milspouse